Terms of Use / Disclaimer

The contents of this website are provided by Japan Asset Management Platform Co., Ltd. for informational purposes only. The information herein is not intended to be, and shall not be construed as, an offer to sell or a solicitation of an offer to buy any securities or other financial instruments, including any securities of our company.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

Business Efficiency and Advancement Support Services

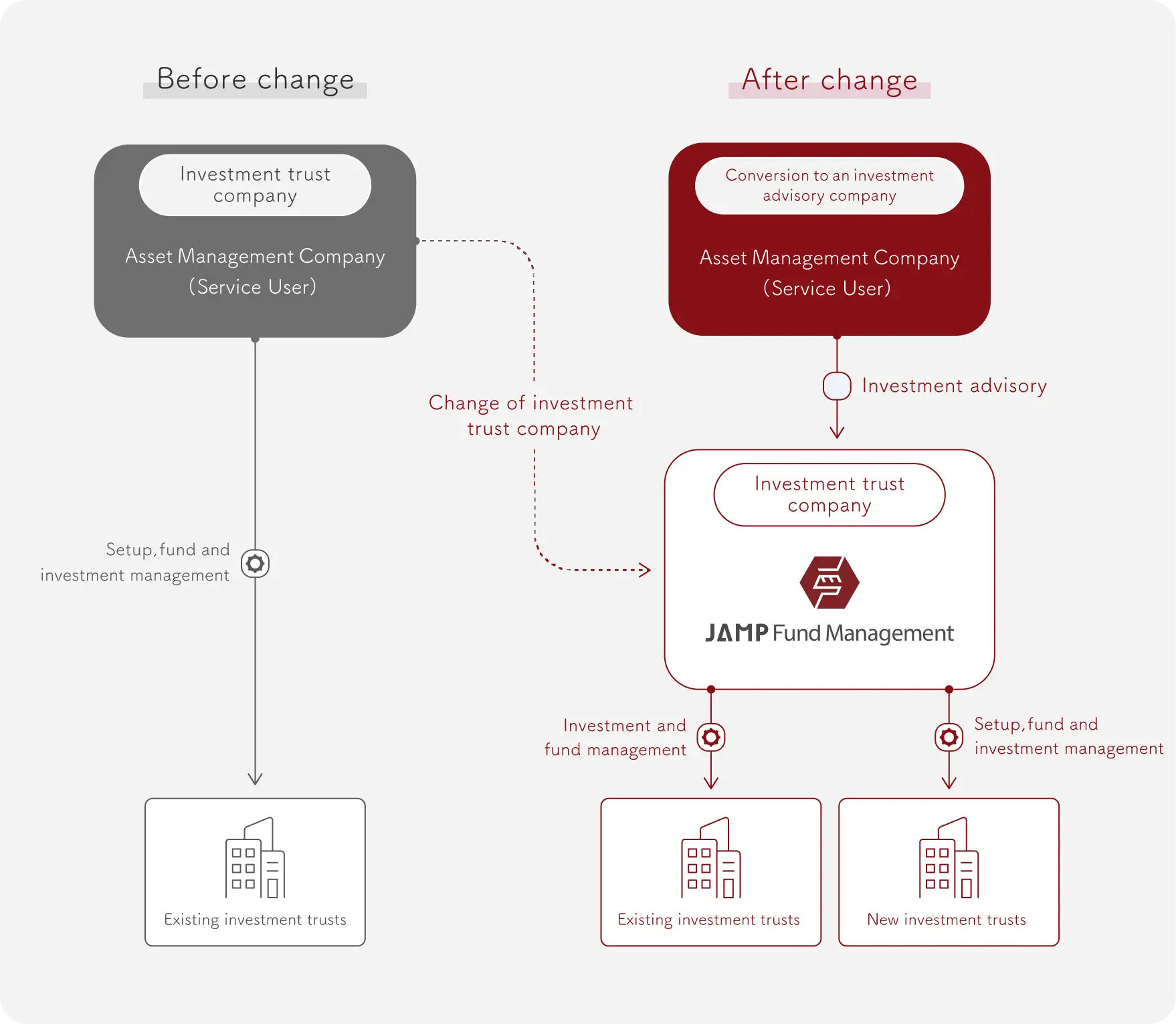

By restructuring the business model, profitability can be significantly improved.

ー Freeing asset management firm to focus on strengthening their investment team, developing new products, and launching new businesses.

Operating a mutual fund management business involves substantial fixed costs, including the build-out of organizational structures and the maintenance of fund accounting systems. In addition, declining management fees and the tightening of product governance regulations have made it increasingly difficult to improve productivity and profitability.

JAMP Fund Management addresses these challenges by offering a Fund Management Company service. Through this service, asset managers can transfer their existing mutual funds to us and transition into an investment advisory firm or a discretionary investment management firm. This allows them to step away from the regulatory obligations of operating a mutual fund management business and concentrate on their true value-added activities—making investment decisions and developing investment strategies.

Beyond cost savings, our service enables firms to redirect resources toward growth initiatives, such as strengthening investment teams, developing new products, and launching new businesses. The service can be implemented not only as a comprehensive business restructuring solution but also on a selective basis—for example, to streamline specific funds or to support ETF operations.

JAMP Fund Management addresses these challenges by offering a Fund Management Company service. Through this service, asset managers can transfer their existing mutual funds to us and transition into an investment advisory firm or a discretionary investment management firm. This allows them to step away from the regulatory obligations of operating a mutual fund management business and concentrate on their true value-added activities—making investment decisions and developing investment strategies.

Beyond cost savings, our service enables firms to redirect resources toward growth initiatives, such as strengthening investment teams, developing new products, and launching new businesses. The service can be implemented not only as a comprehensive business restructuring solution but also on a selective basis—for example, to streamline specific funds or to support ETF operations.