Terms of Use / Disclaimer

The contents of this website are provided by Japan Asset Management Platform Co., Ltd. for informational purposes only. The information herein is not intended to be, and shall not be construed as, an offer to sell or a solicitation of an offer to buy any securities or other financial instruments, including any securities of our company.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

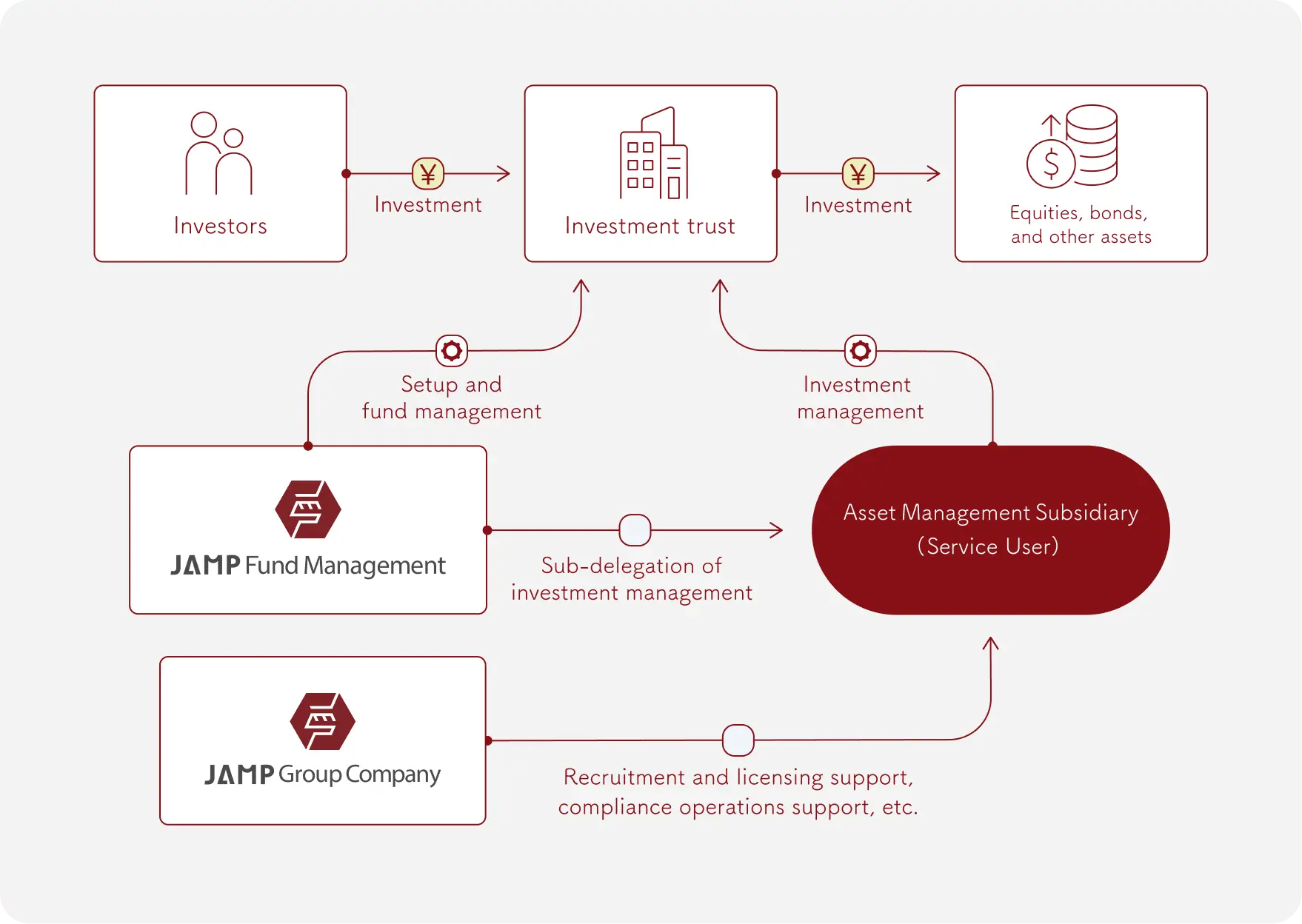

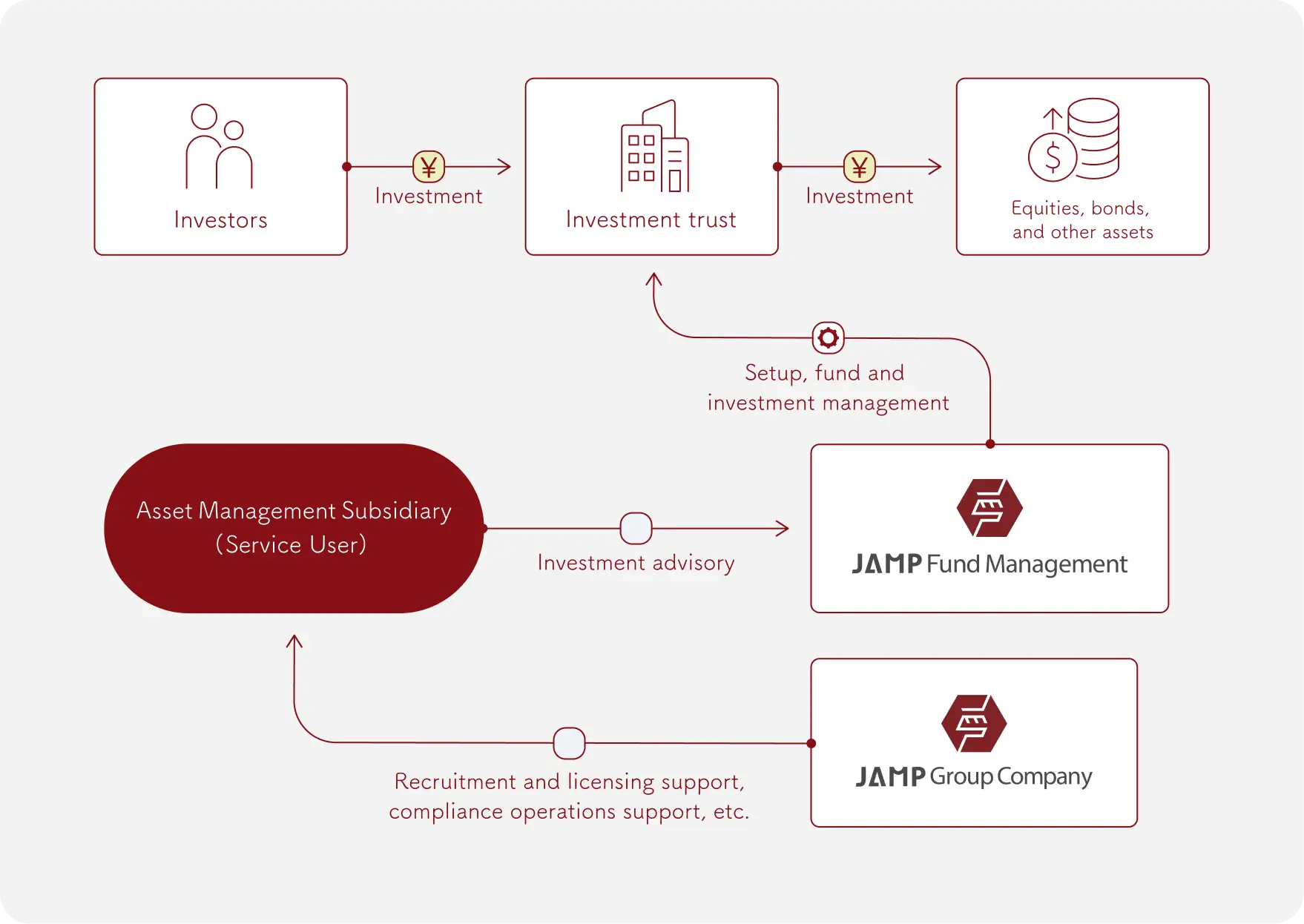

Operating Subsidiary Establishment and Management Support Services

We support the establishment of asset management subsidiaries to enhance securities investment operations.

Against the backdrop of the “return of a world with interest rates” and rising uncertainty in the global economy and markets, enhancing securities investment operations has become a critical management issue for regional banks. Increasingly, these banks are considering the establishment of asset management subsidiaries to advance the sophistication of their market divisions responsible for securities investment and to secure and develop specialized talent.

However, with management fees for investment trusts trending lower and product governance regulations becoming more stringent, it is no longer a rational choice—either from a cost or operational burden perspective—for banks to obtain their own investment trust management licenses and build out organizational structures and systems in-house, as they did in the past.

JAMP Fund Management is a proven first mover in Japan, with a track record of launching the country’s first “Fund Management Company service,” which enables regional banks to establish and operate asset management subsidiaries while keeping costs and operational burdens under control.

However, with management fees for investment trusts trending lower and product governance regulations becoming more stringent, it is no longer a rational choice—either from a cost or operational burden perspective—for banks to obtain their own investment trust management licenses and build out organizational structures and systems in-house, as they did in the past.

JAMP Fund Management is a proven first mover in Japan, with a track record of launching the country’s first “Fund Management Company service,” which enables regional banks to establish and operate asset management subsidiaries while keeping costs and operational burdens under control.

-

Investment Advisory Structure

The asset management company makes the investment decisions, and we execute trades in the designated securities based on their instructions.

-

Investment Management Sub-Delegation Structure

The asset management company handles investment decisions as well as the execution (of a transaction) for the investment securities.

In addition to assisting with the registration of Financial Instruments Business licenses (Investment Advisory or Discretionary Investment Management), Japan Asset Management Platform’s specialized team supports the establishment of a solid operational foundation, including compliance support and recruitment of qualified professionals.