Terms of Use / Disclaimer

The contents of this website are provided by Japan Asset Management Platform Co., Ltd. for informational purposes only. The information herein is not intended to be, and shall not be construed as, an offer to sell or a solicitation of an offer to buy any securities or other financial instruments, including any securities of our company.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

Comprehensive Business Support Services

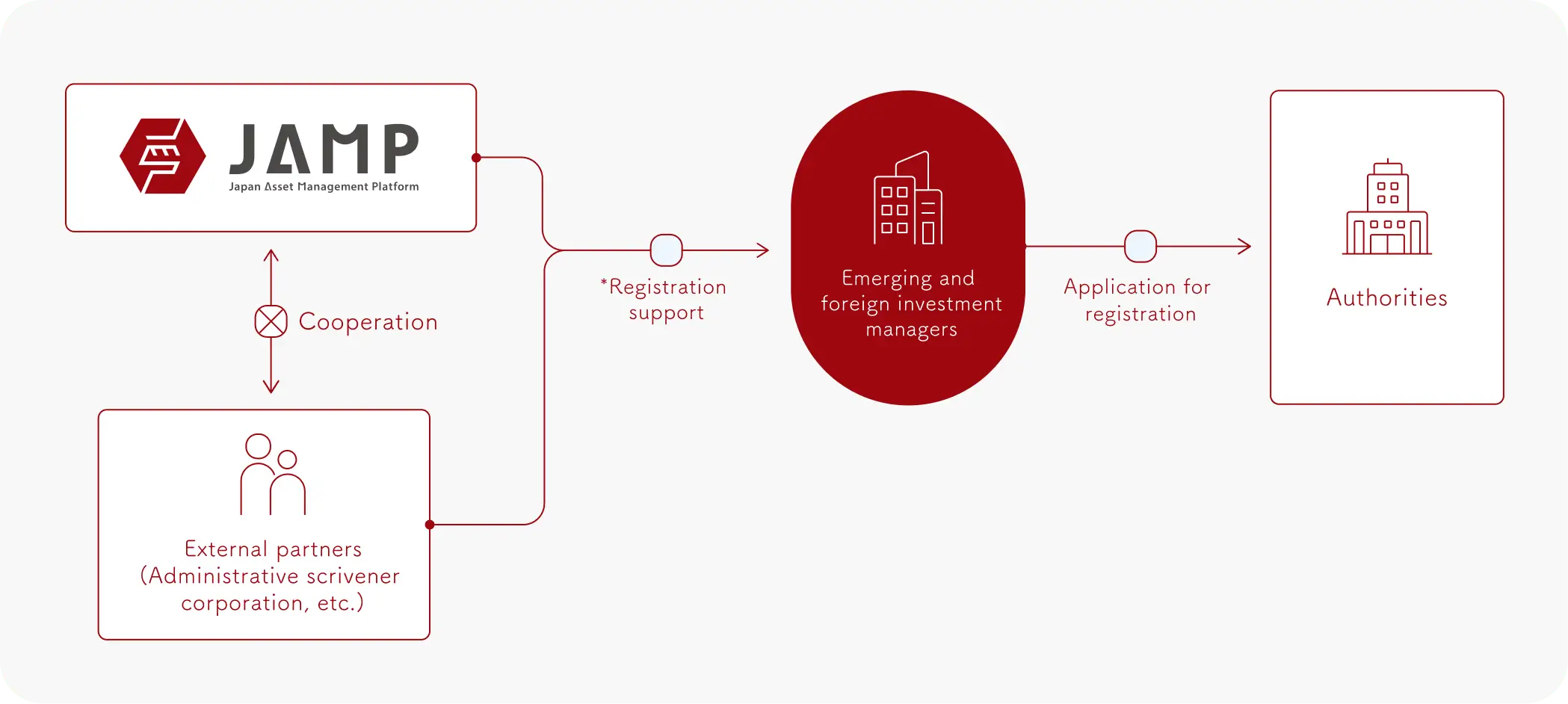

Financial Instruments Business Registration Support Services(investment advisory and agency business / investment management business)

- We support Financial Instruments Business registration to advance your securities investment management.We support Emerging and foreign investment managers in obtaining their Financial Instruments Business license registration.

Our comprehensive support for regulatory applications—including the drafting of necessary rules, regulations, and business descriptions—is provided in collaboration with external administrative scrivener firms.

Compliance support service for the Financial Instruments Business

- We provide an environment where you can focus solely on investment management by supporting your compliance operations.We continuously support the development of internal control systems for Financial Instruments Business Operators and Intermediaries, including the outsourcing of compliance and internal audit functions.

We also handle the registration for the "Investment Management Related Services" (voluntary registration), a system that commenced in May 2025. - What is Investment Management-Related Service Entrusted Business?This business category was established as part of the initiative to create an environment where Investment Management Business Operators can concentrate solely on investment management. This was implemented under the Plan for Realizing an Asset Management Nation, with the aim of promoting new entries into the asset management industry.

The system allows Investment Management Business Operators to outsource their Investment Management-Related Services to entities that ensure appropriate quality. By entrusting these services to an Investment Management-Related Service Entrusted Business Operator, the outsourcing entity can benefit from the relaxation of some registration requirements (specifically, the human resources requirement) for Investment Management Business, etc.

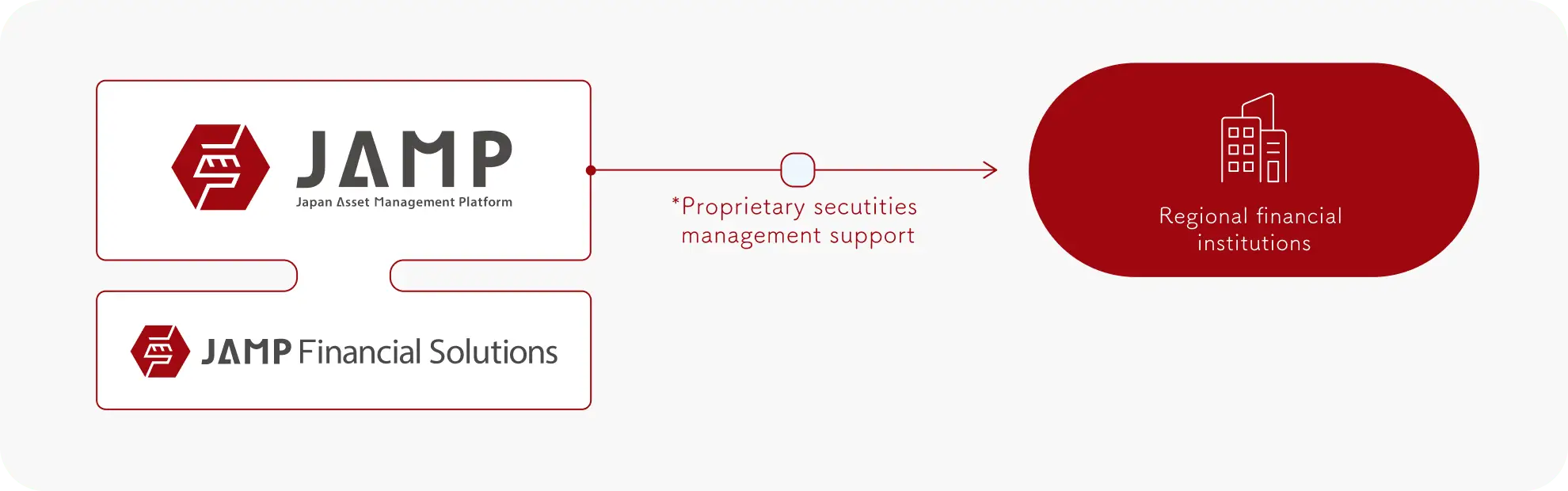

Proprietary Securities Management Support Services (OCIO*)

- We support the sophistication of securities investment management.JAMP assists regional financial institutions facing challenges in their securities investment operations. We provide support for portfolio construction, product selection, investment process management, and risk management from an impartial and neutral standpoint.* OCIO stands for "Outsourced Chief Investment Officer." It is a general term for services where the entire process, from asset allocation decisions to the execution of investment strategies, is either comprehensively or partially outsourced to an external specialist.