Terms of Use / Disclaimer

The contents of this website are provided by Japan Asset Management Platform Co., Ltd. for informational purposes only. The information herein is not intended to be, and shall not be construed as, an offer to sell or a solicitation of an offer to buy any securities or other financial instruments, including any securities of our company.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

This website is not directed at or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any jurisdiction where such distribution, publication, or use would be contrary to law or regulation. This includes, but is not limited to, the United States and U.S. persons.

This website may contain forward-looking statements regarding our future performance, which are subject to risks and uncertainties. These statements are not guarantees of future performance, and actual results may differ. We undertake no obligation to update or revise any forward-looking statements.

While we strive to ensure the accuracy of the information, we do not guarantee its completeness or reliability. All information is subject to change without notice.

By clicking on the "I Agree" link below you acknowledge that you have read and understand the information above.

Goal-Based Approach Solutions (GBASs)

What Is the Goal-Based Approach (GBA)?

The Goal-Based Approach (GBA) is an investment methodology that starts by clearly defining an investor’s objectives (“goals”) and then designing and managing an investment plan to achieve them.

In practice, this means identifying the amount of capital required for each goal, working backward to create a suitable investment plan, and making ongoing adjustments based on portfolio performance and changing circumstances.

Here, “goals” are not short-term profit targets but life-stage objectives within an investor’s broader financial plan. Since every investor’s life stage and financial needs differ, it is common to set multiple goals tailored to each client.

With the Goal-Based Approach, advisors act as trusted partners, guiding clients from goal setting through to achievement.

The concept of goal-based investing has been well established in the United States since the 1990s. Today, more than half of U.S. financial advisors are reported to use this approach, and in recent years it has been gaining growing attention in Japan as well.

In practice, this means identifying the amount of capital required for each goal, working backward to create a suitable investment plan, and making ongoing adjustments based on portfolio performance and changing circumstances.

Here, “goals” are not short-term profit targets but life-stage objectives within an investor’s broader financial plan. Since every investor’s life stage and financial needs differ, it is common to set multiple goals tailored to each client.

With the Goal-Based Approach, advisors act as trusted partners, guiding clients from goal setting through to achievement.

The concept of goal-based investing has been well established in the United States since the 1990s. Today, more than half of U.S. financial advisors are reported to use this approach, and in recent years it has been gaining growing attention in Japan as well.

GBA Evangelist Keiichi Ohara Shares the Untold Story of JAMP’s GBASs

- “I Wouldn’t Recommend Our Own Products to My Family” — A Dilemma Faced Inside an Asset Management CompanyI first encountered the concept of the Goal-Based Approach (GBA) more than ten years ago, when I was in my early thirties and stationed in London as an expatriate for a Japanese asset management firm. At the time, I was responsible for product development, working on the design and launch of products such as the then-popular monthly distribution mutual funds.

Yet, despite being directly involved in creating these products, I found myself unable to recommend them to my own family or friends. Like many professionals in the financial industry, I was often asked questions such as, “Which mutual fund should I buy?” or “How should I approach investing and asset management?” But whenever I was faced with these questions, my honest answer was, “Rather than our company’s products, you’d be better off buying a low-cost index fund.” - “No One Wants to ‘Enjoy’ Financial Services” — The Provocative Question That Changed EverythingAlthough I entered the asset management industry believing I was contributing to society, I found myself unable to take pride in my own work. It was in this difficult period that I came across the concept of the Goal-Based Approach (GBA).

Services such as payments, lending, or insurance are, at their core, no more than lubricants—mechanisms that facilitate present or future economic activity. Using financial services is never the “end” in itself. Seen in this light, not only asset management but all financial services are inherently grounded in the principles of the Goal-Based Approach. - “Not Just Investing, but True Asset Management” — The Moment I Realized That Asset Management Is the Path to Genuine Well-BeingStill, I kept asking myself: why is it that in the world of asset management, maximizing profits is treated as paramount, while the very foundation of the Goal-Based Approach—preparing for future economic needs—is often overlooked?

Through wrestling with this question, I arrived at my own conclusion: “asset management” and “investing” are similar in appearance but fundamentally different in nature. Asset management is a financial service designed to set aside and grow resources for future use, whereas investing is driven primarily by the pursuit of profit—allocating capital in search of returns. - Why I’ve Devoted My Life to the Goal-Based ApproachAlthough what retail clients truly need to secure a stable future is asset management grounded in the principles of the goal-based approach, back then—and even today—many financial institutions, myself included at the time, have been preoccupied with investment strategies that disregard those principles, failing to engage with clients’ actual lives.

Once I recognized this, I made it my life’s mission to deliver genuine goal-based asset management to both individual investors and financial institutions in Japan—a mission I have pursued for more than a decade since returning to Japan. - The Birth of “GBASs” — The Path We Believe In, the Principle We Stand ByJapan Asset Management Platform (JAMP) has been committed, since its inception, to advancing the adoption of goal-based investing. While the term “goal-based approach” is now widely recognized among Japanese financial institutions, we take pride in the fact that no other organization has engaged with this concept as seriously as we have, nor pursued with such rigor the development of services that faithfully embody it.

Our Goal-Based Approach Asset Management Business Support Service (“GBASs”) is designed with absolute dedication to realizing investment services rooted in the goal-based approach. Every element has been carefully refined with no compromise on detail. One example is the financial technology adopted within GBASs known as the “all-in-one fee model mutual fund” (hereinafter, the embedded fee model). Under this structure, the discretionary investment management fee—normally charged to retail clients for discretionary portfolio management services—is collected instead as part of the trust fee of a dedicated mutual fund that serves as the investment vehicle.

This model was originally developed by us after my return to Japan, specifically to bring the goal-based approach into practice. Its purpose goes beyond the significant operational benefits of reducing administrative burdens associated with discretionary investment services. Above all, it reflects our core belief that, under a goal-based framework, what should be customized for each individual client is not merely the portfolio, but the asset management plan itself—tailored to prepare for their future financial needs. - A Future Shaped with Our Partners – Building on Both Successes and Setbacks to Forge a New Horizon for GBASsBy building on each of these innovations and refinements, our “GBASs” provides partner financial institutions with everything they need to make goal-based asset management a successful business. We continually enhance the service by incorporating both the successes and challenges we experience together with our partners, ensuring sustained support for institutions committed to delivering goal-based asset management.

GBA Evangelist Keiichi Ohara Shares the Untold Story of JAMP’s GBASs

The Journey of JAMP’s GBASs

Since 2022, Japan Asset Management Platform (JAMP) has been offering its Goal-Based Approach Asset Management Business Support Service, “GBASs,” in collaboration with multiple platform providers (as outlined below). The combination of clearly defined goals and the presence of advisors has resulted in low redemption rates, attracting growing interest from regional financial institutions seeking to move away from market-dependent business models.

Successful vs. Failed Goal-Based Asset Management Businesses

In recent years, more services and initiatives have adopted the label “Goal-Based Approach.” However, as pioneers in goal-based asset management businesses—specifically goal-based discretionary investment services, or what we call “GBA Wraps”—we often encounter cases that feel inconsistent with the true spirit of the approach.

- JAMP’s Critical Observations

-

The “goal-based approach” is not about selling financial products; it is about delivering a service.

In conventional non-GBA wrap accounts, even when the term “goal-based approach” was used on the surface, the reality was not true wealth management (see “From ‘Investing’ to ‘Wealth Management’” in The Origins of JAMP’s GBA). In practice, it was no different from traditional mutual fund sales—essentially just investment solicitation. -

A goal-based approach cannot be achieved through non-face-to-face channels.

Its success fundamentally depends on the presence of human advisors. While AI may be able to suggest optimal portfolio allocations, it cannot draw out a client’s underlying needs. That requires conversations with an advisor who can engage with clients on a personal level. -

Claiming to provide a goal-based approach while relying on conventional mutual fund sales methods amounts to nothing more than investment solicitation that bears no connection to the client’s actual goals—and may ultimately undermine client trust.

If the client experience falters at the very entry point of the service, rebuilding credibility and structure requires substantial effort.

-

The “goal-based approach” is not about selling financial products; it is about delivering a service.

- Why does “goal-based” so often fail in practice?From our perspective, having observed a wide range of cases, the reason is strikingly simple:

Although firms claim to pursue a goal-based wealth management model, the way they present proposals and design plans is not goal-based at all. - The Formula for Success: Becoming an Indispensable Advisory Institution for ClientsWhen advisors combine an understanding of client psychology with a genuine grasp of the goal-based approach, they are able to deliver goal-based planning and follow-up.

By leveraging sales scripts that are grounded in both client psychology and the principles of goal-based wealth management, advisors can uncover clients’ true needs.

Capturing these real needs and building open, trust-based relationships with clients makes it possible to deepen engagement and strengthen business relationships.

Moreover, JAMP’s proprietary GBASs framework incorporates insights from behavioral economics into its goal-based follow-up process. - The Formula for Success: Becoming an Indispensable Advisory Institution for ClientsThe reason the shift “from savings to investments” has made so little progress is that proposals have largely focused on clients’ satellite assets, while failing to link day-to-day core assets to wealth management.

Because channeling core assets into investment has proven difficult under conventional approaches—namely, mutual fund product sales and investment solicitation—JAMP, with its deep expertise in the goal-based approach, has designed and will provide a Foundational Onboarding Training Program for advisory firms. (In practice, traditional mutual fund sales and solicitation did nothing to move the so-called “immovable” deposit base.)

Through this initiative, we aim to ensure that advisory firms can get off to a smooth start by equipping them with the GBASs Method.

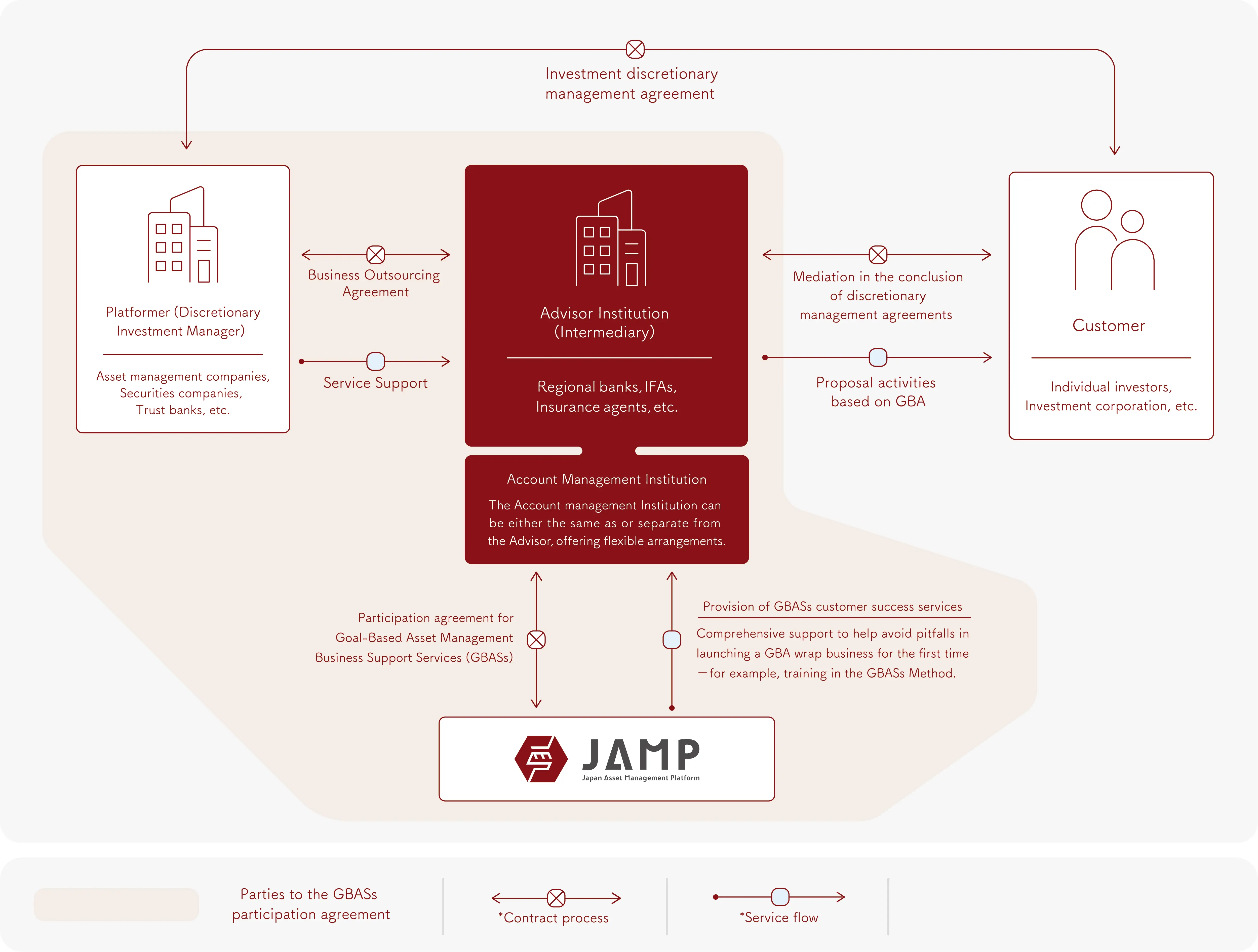

GBASs from the Perspective of Platform Providers (Discretionary Investment Managers)

Overview

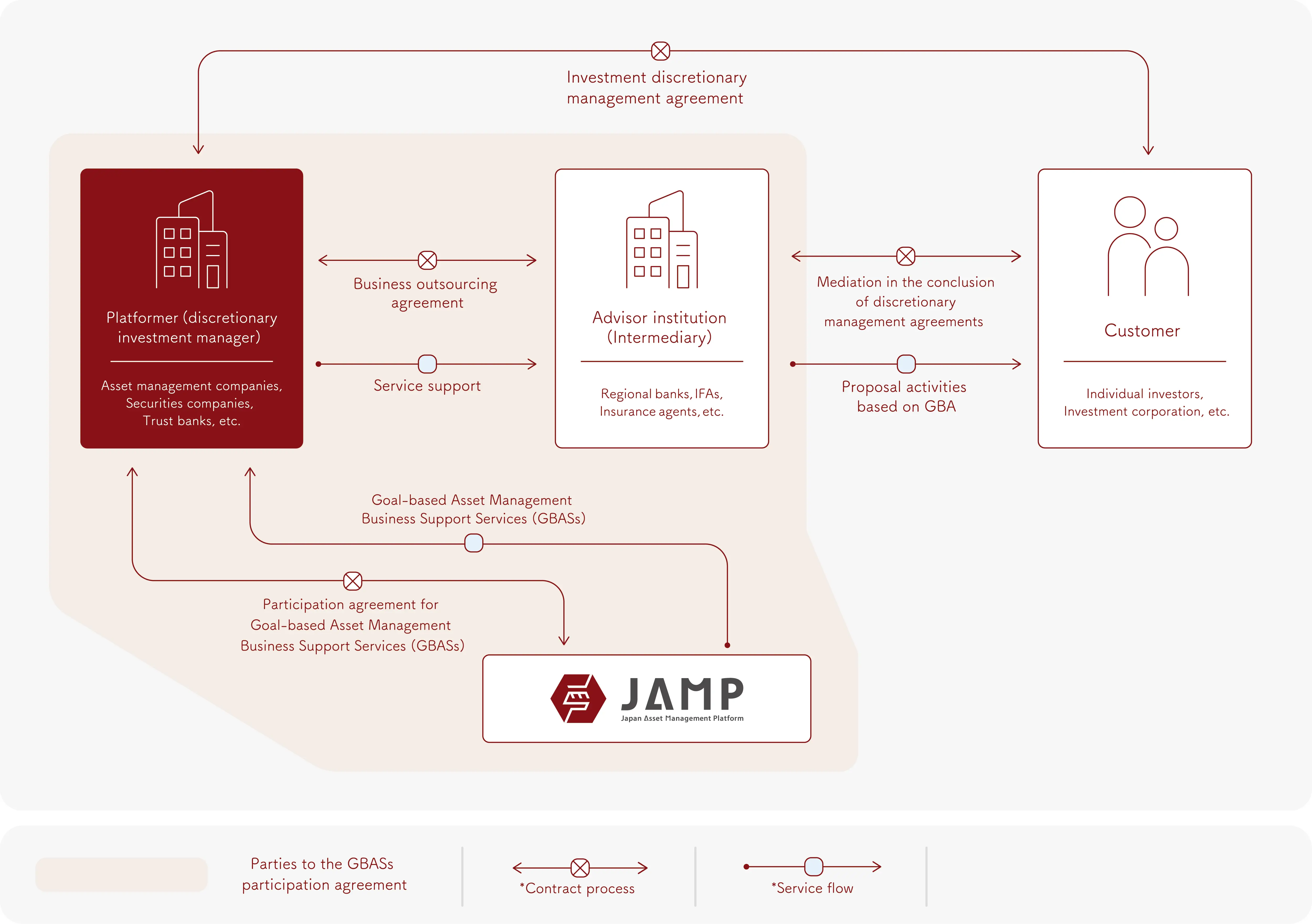

In the context of GBASs, a discretionary investment manager is referred to as a “Platform Provider.”

Asset management companies, securities firms, and trust banks serve as Platform Providers, working in collaboration with regional banks, securities brokers, credit unions, and IFAs (collectively referred to below as Advisory Institutions) to establish a new goal-based approach (GBA) wealth management business.

In partnership with its business collaborators, JAMP provides Platform Providers with GBASs—a suite of services that includes the systems solutions and business process outsourcing necessary to operate a goal-based wealth management model, as well as additional resources designed to ensure the Platform Provider’s success.

Asset management companies, securities firms, and trust banks serve as Platform Providers, working in collaboration with regional banks, securities brokers, credit unions, and IFAs (collectively referred to below as Advisory Institutions) to establish a new goal-based approach (GBA) wealth management business.

In partnership with its business collaborators, JAMP provides Platform Providers with GBASs—a suite of services that includes the systems solutions and business process outsourcing necessary to operate a goal-based wealth management model, as well as additional resources designed to ensure the Platform Provider’s success.

Key Features

- Enter the goal-based wealth management business with reduced burden.

- By outsourcing discretionary investment operations to JAMP, you can reduce operational workload and run the business with fewer resources.

- Unlike mutual funds and wrap accounts that emphasize portfolios, this service is designed around planning and process.

- By applying our proprietary Embedded Fee Model, you can reduce the burden of system development while also leveraging functions that effectively implement goal-based approaches such as recurring contributions, withdrawals, term adjustments, and NISA.

- Multiple goals (up to ten) can be set in line with each client’s life plan.

The Embedded Fee Model refers to the “Discretionary Investment Model Utilizing Mutual Funds with Embedded Fees.”

GBASs from the Perspective of Advisory Institutions (Intermediaries)

Overview

les representatives are referred to as Advisors.

Advisory Institutions engage in planning based on the Goal-Based Approach (GBA), as well as follow-up activities based on GBA, and act as intermediaries for the execution of discretionary investment agreements.

In collaboration with its business partners and Platform Providers, our firm provides Advisory Institutions with the business infrastructure they need.

We also deliver a range of services essential for their business growth.

Advisory Institutions engage in planning based on the Goal-Based Approach (GBA), as well as follow-up activities based on GBA, and act as intermediaries for the execution of discretionary investment agreements.

In collaboration with its business partners and Platform Providers, our firm provides Advisory Institutions with the business infrastructure they need.

We also deliver a range of services essential for their business growth.

Key Features

- Enter the goal-based asset management business with reduced burden.

- Transition away from a market-dependent business model to a stock-based (recurring revenue) model.

Through initiatives embedded in the GBASs Method, you can establish or strengthen client engagement and deepen business relationships. - By utilizing in-house accounts, you can prevent capital outflows.

- For advisors, goal-based wealth management services provide a way to become indispensable to clients—without pressure, without asking, without pushing.

This contributes to stronger client relationships and higher advisor retention. - By applying our proprietary Embedded Fee Model, you can reduce the burden of system development while also leveraging functions that effectively implement goal-based approaches such as recurring contributions, withdrawals, term adjustments, and NISA.

- Multiple goals (up to ten) can be set in line with each client’s life plan.